The notion of “dividing” something isn’t at the top of your list as an investor.

However, a split in your stock holdings could be advantageous for your portfolio.

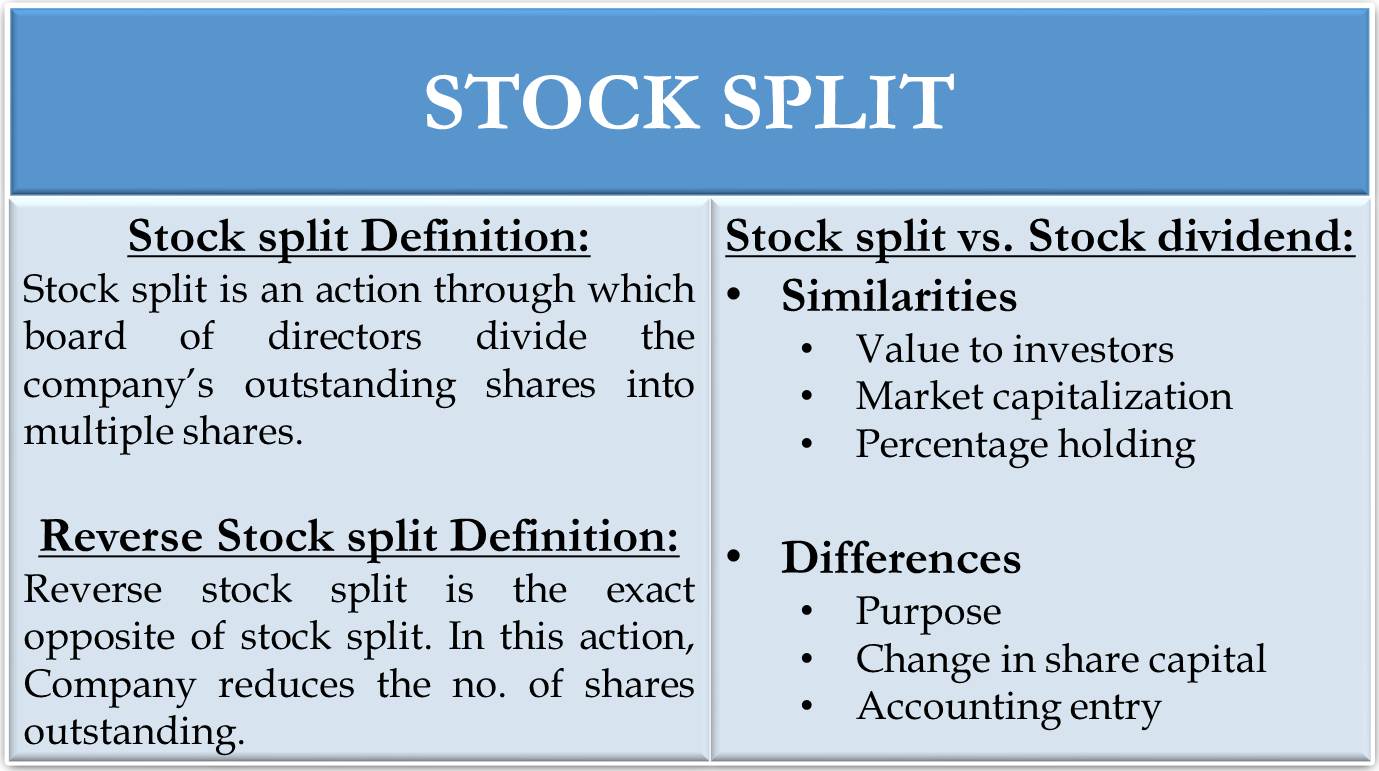

A stock split happens when a business reduces the price of its current shares to create a considerable number of cheaper ones.

In a stock split, the company’s overall value stays the same. A split may reduce the price per share, but it doesn’t affect the company’s market capitalization. This is because there are more shares to go around.

Suppose you’re already a shareholder in a company when it declares a stock split, only a few changes. Nevertheless, it’s vital to grasp how stock splits work, especially for understanding how the market may react post-split.

Example of a stock split

Consider the case where Apple (AAPL) divides its stock four into one. For simplicity, you own one share of Apple stock.

Apple gives you three more shares due to its 4-to-1 split, giving you four. However, each share is only worth 25% of its previous value. Therefore, the four shares are equal in value to the original share.

The outcome is the same for current shareholders; the share’s total value stays unchanged. Said there are more pie slices.

For fresh investors, since a lower value per share means purchasing at lower prices, a declaration of a stock split can signal a time to buy.

In general, stock splits indicate to the market that the firm is confident that the share price will rise in the future, and that it is rising.

There are various reasons why a firm could think about splitting its shares. However, since stock splits don’t increase market value, they primarily affect investors’ behavior by making stocks more accessible to them.

Here are the top three justifications for a firm splitting its stock:

Make the stock more affordable: The primary goal of a stock split is to decrease the cost of a costly stock, especially when compared to other companies in the same sector. In addition, this will give rise to the number of investors who can purchase it.

Create more liquidity: By increasing the number of shares in circulation, a stock split can boost liquidity, facilitating stock trading. Investors benefit from increased liquidity because it makes acquiring and selling equities at fair prices more effortless. Trades may also be completed considerably more quickly.

Rekindle interest: A corporation is frequently viewed as successful when its stock divides. Therefore, investors can infer that the firm has been successful and must be a solid investment because the share price is so high that it must split its stock.

FINAL INSIGHT

After the initial decline in share price, a stock split frequently sees a rise. As a result, a stock becomes more accessible to investors because of the price reduction, increasing demand, and price.

When a firm splits its shares, the value of current investors’ holdings stays the same. They just acquired more shares, albeit at a reduced cost per share. As a result, their total investment is worth the same as before the split.