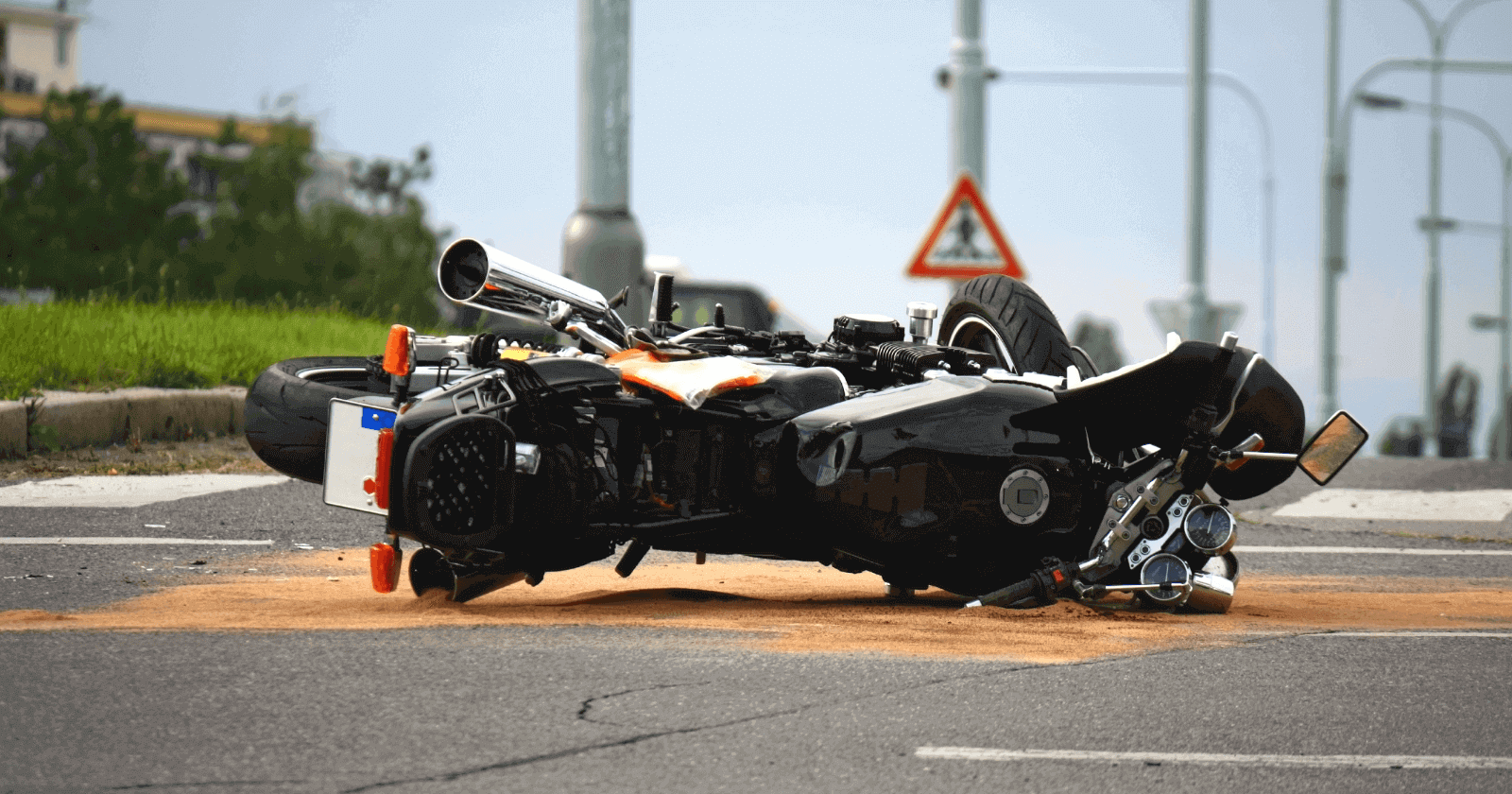

Finding the right bike insurance plan is the first step in getting your bike insured. Once you have that, you can rest easy knowing that your insurance will either fully or partially cover the cost of repairing or replacing your motorcycle in the event of damage.

Finding the right bike insurance plan is the first step in getting your bike insured. Once you have that, you can rest easy knowing that your insurance will either fully or partially cover the cost of repairing or replacing your motorcycle in the event of damage.

Once you file a bike insurance claim, your bike insurance will pay the expense. Nowadays, filing a claim is easy, thanks to online insurance portals. You can file an insurance claim if a natural or man-made disaster damages your bike.

You should also know that the insurers provide policyholders with a No Claim Bonus feature. You receive a concession on the premium if you do not file any claims during a specific year. Every year without a claim increases the concession amount (up to 50%).*

Types of Insurance You Can Obtain

You can make a claim for either a comprehensive policy or third-party insurance.

1) Comprehensive insurance

It covers any theft or vehicle damage. It also includes any money you owe a third party due to a car accident.

2) Third-party insurance

Only the damages to a vehicle that your bike has caused are covered by this policy. Your bike’s damages are not covered by it. The cost of two-wheelers’ third-party insurance is low.

Type of claims

There are two different ways to submit a claim for your bike insurance.

Cashless claim

In a cashless bike insurance claim, the insurer handles this by paying your bills directly to settle your expenses on your behalf. It would help if you took the following actions to support your claim:

- You must write down the vehicle’s registration number if your bike is involved in an accident.

- You will require your vehicle’s engine and chassis numbers, inspection location, and kilometre reading.

- After this, contact the insurer by phone or email or utilise their online portal.

- You must use the ‘Claim’ option online to submit your claim. Once it is finished, you will get a confirmation message with a claim number. The insurer will then contact you to inform you what paperwork and evidence you need to submit a bike insurance claim.

- In the event of a serious accident, injury, third-party property damage, key loss, or theft, you must file an FIR at the police station before making a bike insurance claim.

- You have to take your car to a garage or repair facility the insurance provider recommends if there is damage.

- When filing an insurance claim, you must provide your driver’s licence, bike registration certificate, KYC information, and claim form.

- The insurance company will designate a surveyor to evaluate your claims.

- Once the repair or replacement work is finished and your claim meets the terms and conditions of the policy provider, they will take care of the bill.

Claim for reimbursement

With this choice, you are responsible for all costs upfront; the insurance company will reimburse you if your claim is approved. You must submit the repair or replacement invoice. To stay protected, ensure your bike policy renewal is promptly completed.

* Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.